How Knowing Your Data Inside Out May Save You Billions

We are living in a world where technology is both revered and feared. We learn about futuristic technologies in popular narratives through sci-fi series like Black Mirror or Better Than Us. Often, technological advances in such narratives position robots and advanced intelligence to intimidate rather than impress. The bottom line is not about how robots will someday rule the world, but the misuse of technologies and innovation can bring genuine threats to our societies.

And the threats are not that far from home. In recent months during lock-down, one in every six Australians experienced some form of cybercrime. These statistics suggest a general shift of lives and businesses to the digital space during lock-down, with 4 out of 5 Australians saying that they are more dependent on technology than ever before. Information security can be enforced relatively easy within a business environment if they have deployed robust levels of both security solutions and infrastructure. But when employees becoming increasingly mobile, or as what we mentioned earlier, home-based, cyber security risks are no longer issues more pertinent to smaller, less security-savvy organisations, even the bigger boys like financial institutions or banking corporations may fall prey to cyber criminals through the unwitting security loopholes of their home-based workforce.

According to AUSTRAC’s latest sharing on Fintel Alliance, criminals are no longer committing petty crimes. They can abuse systems, networks, and data to commit crimes like human trafficking and terrorism. These crimes not only endanger our citizens but puts our homes and economies at risk. AUSTRAC aims to stem such criminal activities by leveraging technologies to provide the most effective collaborative working environment and exploration of advanced technologies that will extend the financial detection capabilities of AUSTRAC and industry.

Uncovering Data Risks and Gain an Upper Hand against Crime

Criminal techniques are becoming more sophisticated, for example, mule accounting (using an often coerced third party to collude in the payment chain), hibernation fraud (conducting regular transactions during an initial period of scrutiny, and when that period finishes, running up massive debt), under the radar transactions and front running (many small trades, and in front of the broader market).

One way to stem such criminal techniques using data management solutions is to create a 360 environment where no data is left unmanaged. Instead of choosing a Master Data Management approach or transactional data levelling, Anything 360 by TIBCO provides users with consistency, context, and accurate information on every entity. There are two ways we can use data in a 360 environment.

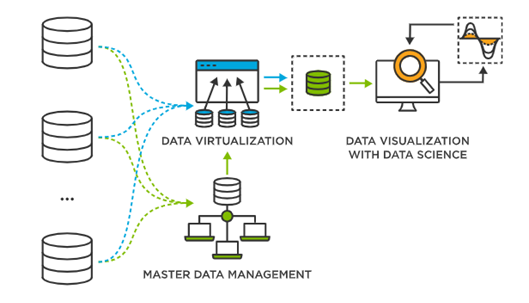

How data virtualization and MDM create blended 360o views

With an Anything 360 environment where data is fully transparent, organization (owners of massive data) can maintain a bird’s eye view on all transactions, analytics, and data. This approach limits the possibilities of organizations unknowingly allowing for money-laundering efforts, which in turn can be used to fund criminal activities like human trafficking and terrorist acts locally or overseas. Most 360 solutions require extra copies of data and can result in inconsistency, increased risk, and compliance challenges. With TIBCO, unnecessary replication is eliminated, so we can mitigate risk, reduce costs, and deliver the most up-to-date and complete information on-demand.

The resulting risks and challenges are not just hypothetical. We have seen many real-world cases where conglomerates, private enterprises and even banking corporations suffering billions of dollars in fines and losses, due to a lack of early warnings for fraud detection, made worse with the lack of a clearly documented, systematic approach to compliance and regulations. These cases are not limited by geos or regions but can happen to anyone at any time. Even as policymakers update regulations and compliance policies, businesses must remain compliant and be agile enough to address any potential risks immediately.

The application of having data virtualization and MDM creating a blended 360o view is not merely a framework, but a practical means to quickly adjust, scale and enforce compliance and governance by means of technology, solutions, and adherence to regulatory rules.

Secondly, combining 360 environments with machine learning (an example of advanced technologies) can help track trends, identify opportunities and threats, and gain a competitive advantage with anomaly detection. Traditional fraud detection and investigation can be lengthy, error-prone, and complicated. Suppose you were playing a game of cat and mouse with cybercriminals. In that case, you want to have the upper hand with advanced and agile technologies that can be adaptive and scalable to evolving compliance, governance, and regulations. For example, the combination of predictive analytics, streaming analytics, and business process management provides a powerful and cost-effective system for detecting fraud.

The challenges facing our world—and the organizations and communities dedicated to using a data-centric approach to achieving both incremental and frame-breaking successes—require no less than the best technologies and expertise. As a TIBCO partner, we are working closely with several financial institutions in the country to develop a strategic data roadmap tapping on TIBCO’s industry-leading portfolio of products and solutions to address such concerns. We are committed to organizations, big or small, to achieve greater operational and innovative capabilities and work collaboratively with our partners, communities, and citizens to use data for good.

Clean data is the first step in prevention and connected data is the second. Ascention’s Data Management Framework and Clean Data Processes will help you assess your risk and unearth potential gaps of data leakage, fraud, money laundering, data breaches and elevate hefty fines from regulatory agencies.

If you believe your organisation may be at risk or would like to explore how Ascention and TIBCO technologies can help you accelerate your clean data journey, contact us for a discovery session on how you can master your data inside out and prevent your business from losing billions.

Ascention Data As A Language series

Please see previous topics:

- Data As A Language (Whitepaper, 7 minute read)

- No, The Stork did NOT bring your Data (blog, 3 minute read)

- Data Governance Foundations (Whitepaper, 10 minute read)

- Ascention named in Gartner 2020 Market Guide for MDM External Service Providers (Research Article, 30 minute read)

- How Data Governance Translates to Superior Customer Experience (Webinar, 60 minute watch)

- Where Unity Delivers Clarity – How MDM & a DeLorean Increases Transparency for your Organisation (Article, 5 minute read)

- What Story is Your Data Saying? (Video blog, 19 minute watch)

Ascention Shares Experience

Ascention wishes to impart skills and knowledge. The team at Ascention is always willing to share our experiences to assist your team’s progress – simply contact us to start an informal, no-obligation discussion.

Ascention Contact:

Dan Cox, Chief Executive Officer

E: dan.cox@ascention.com

M: +61 419 485 420